Money counting worksheet: Grade 2 Counting Money Worksheets — free & printable

Posted onCounting Coins & Making Change

Counting Money: USA

Identifying Coins (Very Basic — No Counting)

Learn to identify coins, coin names, and their values. This page has worksheets, task cards, as well as cut-and-glue activities.

example: What coin is this? Quarter.

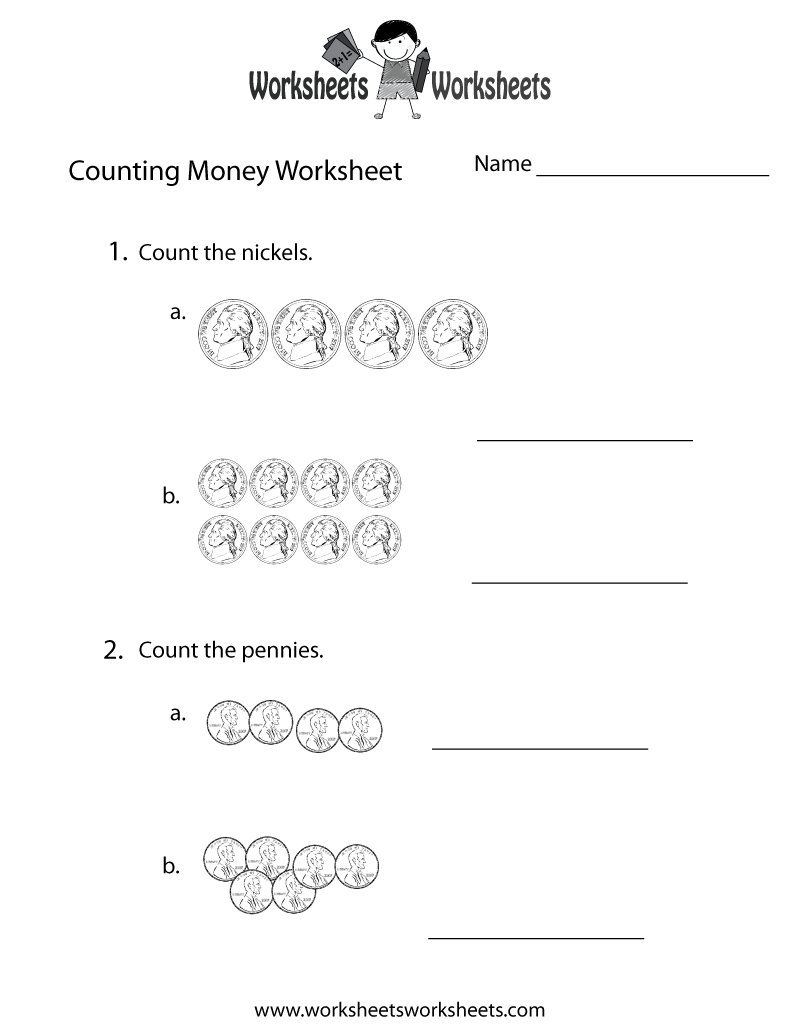

Counting Individual Coin Types (Very Basic)

This page will have students counting sets of pennies only, nickels only, dimes only, and/or quarters only. These basic-level activities are designed primarily for students in Kindergarten and 1st grades.

example: Three nickels. How much money is shown? 15 cents.

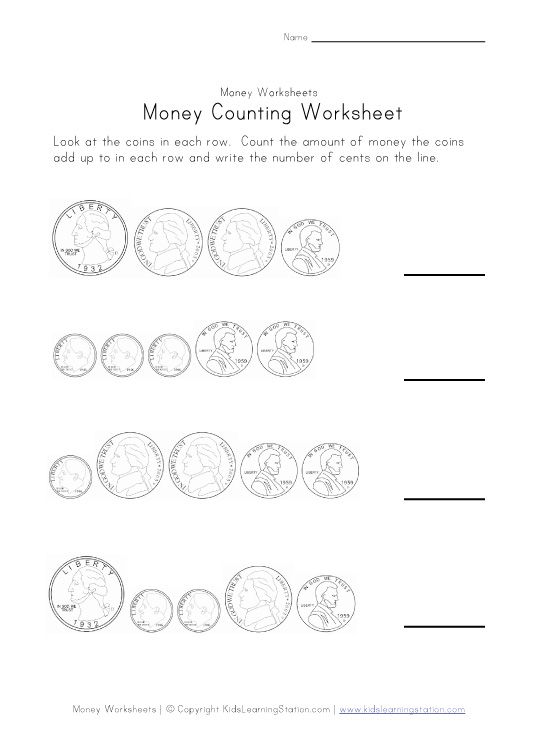

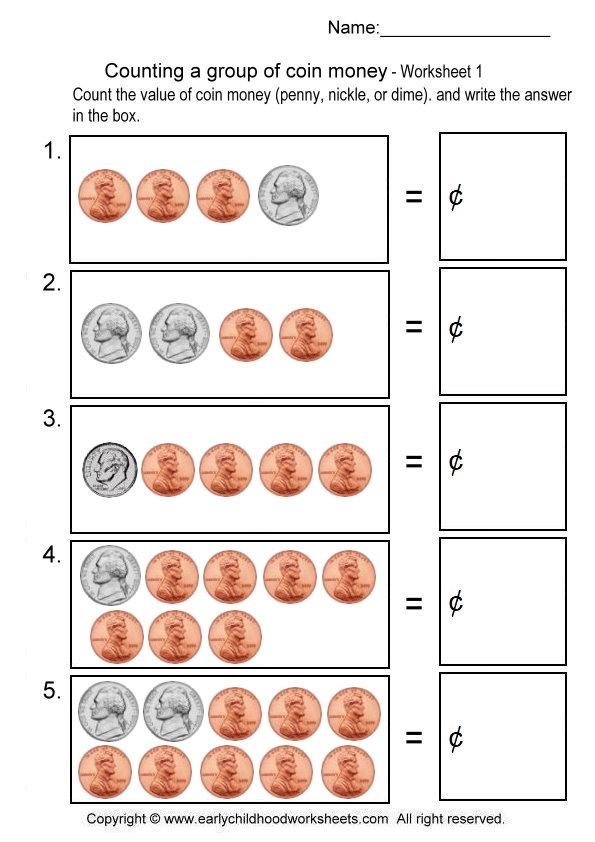

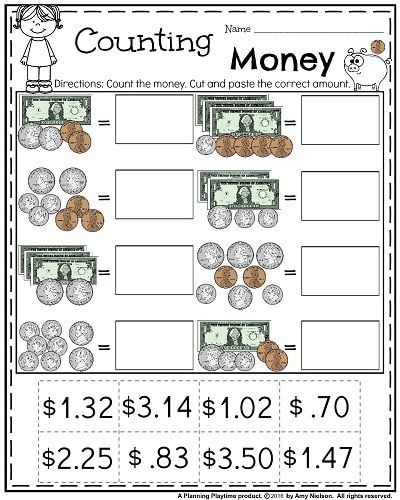

Counting Mixed Coins (Basic)

Print worksheets and games on counting mixed coins. This page features basic level activities best suited for students in 1st and 2nd grade.

example: 1 nickel and 3 pennies. How much money is shown? 8 cents.

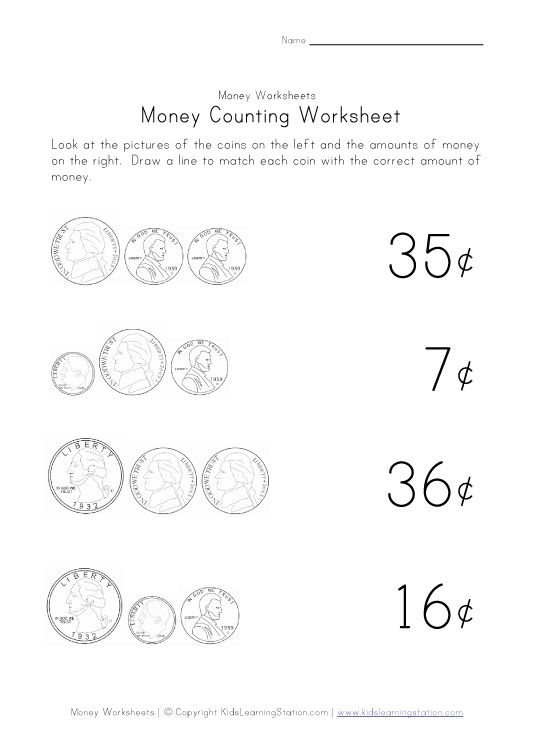

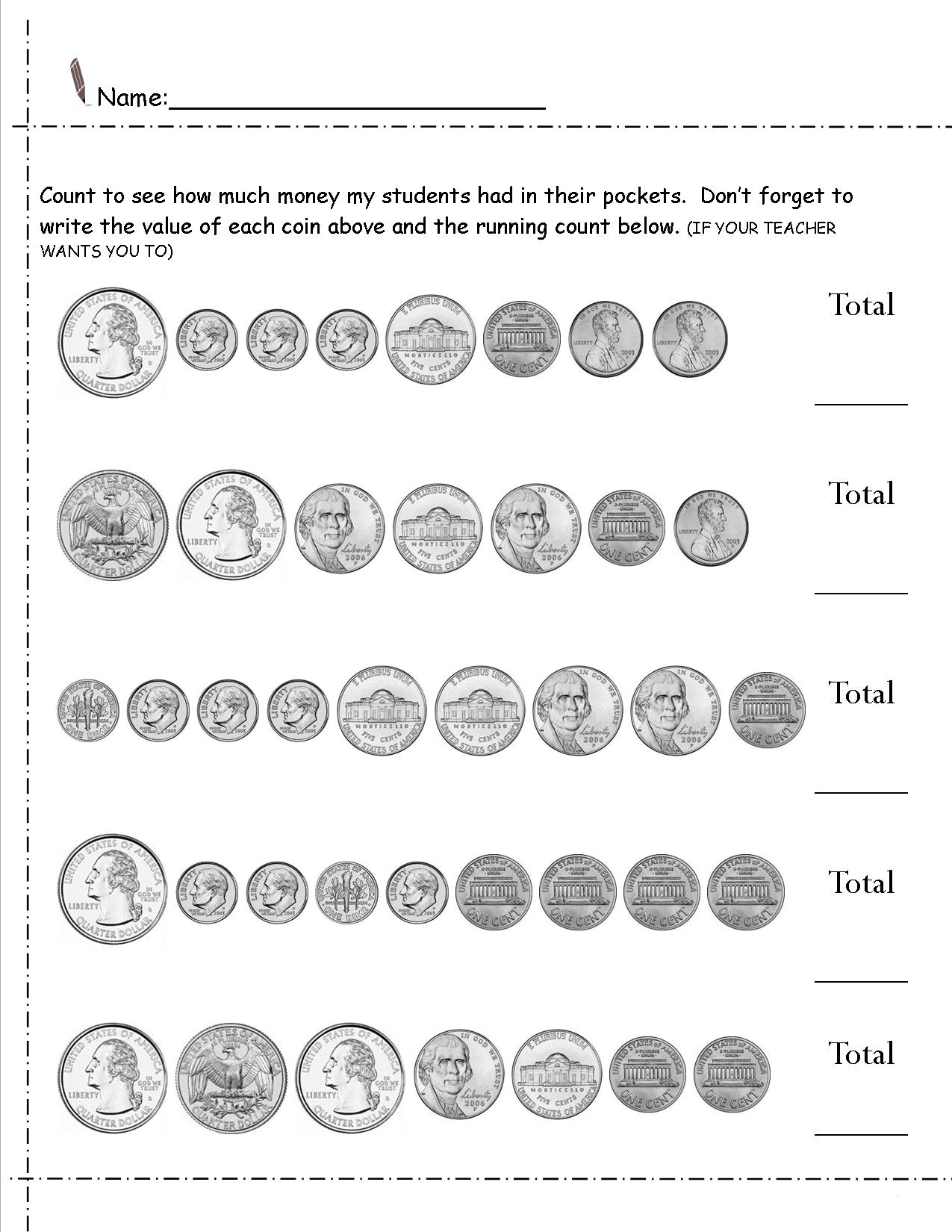

Counting Mixed Coins (Intermediate)

Here are some more advanced worksheets on counting mixed coins. These were designed for students in 2nd through 4th grades.

example: 2 quarters, 5 dimes, six nickels, and two pennies. How much money is shown? $1.62

Counting Coins and Bills (Advanced)

This page has worksheets split up into 3 groups: counting money up to $4.00, counting money up to $12.00, and counting money up to $50.00.

example: 2 twenty dollar bills, 6 quarters, and 7 nickels. How much money is shown? $41.85

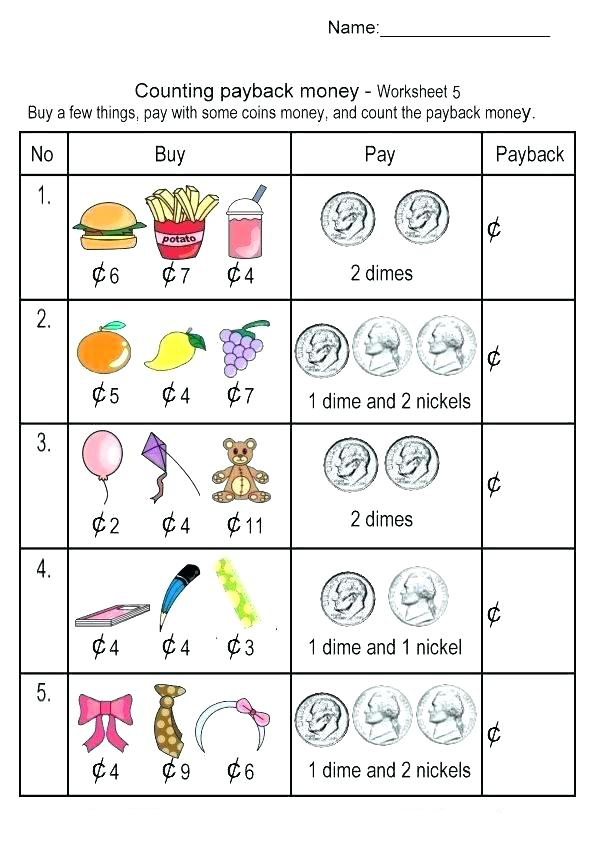

Making Change

Making Change

With these worksheets, students can practice making change. Includes task cards, word problems, and other printables.

Operations with Money

Adding Money

Practice adding money amounts with these printable worksheets, task cards, and games.

Subtracting Money

Print out these files to supplement your lessons on subtracting money and using subtraction to make change. Includes worksheets, a ‘magic digits’ game, and task cards.

Multiplying Money

Multiply money amounts by 1-digit numbers.

Money Place Value & Rounding

Comparing and Ordering Money

Use the mathematical symbols for greater than, less than, and equal to to compare money amounts.

Rounding: Money to Nearest Dollar & Nearest Dime

With these activities, students will learn to round money amounts to the nearest dollar or the nearest ten cents.

Rounding: Next Dollar Up

Unlike regular rounding, on these worksheets students will always round up to the next dollar to determine how many bills are needed. For example, a t-shirt costs $6.29. You’d round up and give the cashier $7.

Counting Money: International

Counting Money: Australian

These printable worksheets and games have Australian coins and banknotes on them.

Counting Money: Canadian

This page will have students counting Canadian toonies, loonies, quarters, dimes, and nickels.

Counting Money: United Kingdom

Count British pounds. Banknotes and coins include £2, £1, 50p, 20p, 10p, 5p, 2p, and 1p coins. Includes task cards, worksheets, and class games.

Browse Printable Money Math Worksheets

Entire LibraryWorksheetsGamesGuided LessonsLesson PlansHands-on ActivitiesInteractive StoriesOnline ExercisesPrintable WorkbooksScience ProjectsSong Videos

269 filtered results

269 filtered results

Money Math

Interactive Worksheets bring printable worksheets to life! Students can complete worksheets online, and get instant feedback to improve.

Open an Interactive Worksheet, and create a direct link to share with students. They’ll enter their code to access the worksheet, complete it online, and get instant feedback. You can keep track of submissions in My Assignments.

Learn more

Show interactive only

Sort byPopularityMost RecentTitleRelevance

-

-

Filter Results

- clear all filters

-

By Grade

- Preschool

- Kindergarten

- 1st grade

- 2nd grade

- 3rd grade

- 4th grade

- 5th grade

- 6th grade

- 7th grade

- 8th grade

-

By Subject

- Fine arts

- Foreign language

-

Math

- Number Sense

- Addition

- Subtraction

- Multiplication

- Division

- Mixed Operations

- Fractions

- Decimals

- Percents, Ratios, and Rates

- Algebra

- Geometry

- Measurement

- Time

-

Money Math

- Identifying Coins

- Operations with Money

- Data and Graphing

- Math Word Problems

- Math Puzzles

- Reading & Writing

- Science

- Social emotional

- Social studies

- Typing

-

By Topic

- Coloring

- Holidays

- Offline games

- Seasonal

-

By Standard

- Common Core

Search Printable Money Math Worksheets

Understanding how math intersects with money is at the heart of our money worksheets.

Teach Kids that Money and Math Go Hand in Hand

The sooner your child understands all the components of money, the sooner she will understand (and appreciate) the value of it. Which is precisely where our money worksheets come into play. Besides teaching young kids fundamentals like the value coin and paper money (and their differences), our money worksheets improve counting, sorting, and basic arithmetic skills. Several printables even put kids in real world money scenarios, like how to make change at a sporting goods store and how to match money amounts to the cost of items at a bake sale.

Speaking of real world scenarios, consider using everyday life events to teach your kids about money.

example, how it works, pros and cons, how to use

Excelki

Satisfy the thirst for self-control and develop financial discipline

This is a Community story. The editors asked leading questions, carefully edited and designed according to the standards of the journal.

Norf

adopted his father’s experience

Author’s profile

My father has been keeping track of his expenses since the beginning of zero in spreadsheets in Excel.

He has kept track of the family budget for as long as I can remember. Once, such a story even happened: I needed a floppy disk for an informatics lesson, I found it at home, inserted it into my computer and saw some files. I thought that there must be copies of them, and deleted, did not even save the data on the computer: I have no idea why I did this. As a result, I deleted my father’s spreadsheets with expenses for six years in the period of the late nineties — early zero.

Father encouraged me to get my own sign. So, in high school, I also started writing down how much money I have and how much I spend. I counted every coin, but after a while I scored and started over. At that time, the table quickly got boring, because I already knew that I had 500 R and I needed to save up the same amount to buy the toy I wanted. There was no need for cost accounting, but the idea itself caught on.

When I was a student, I started to pay more attention to the budget. My spreadsheet grew more complex and moved to Google in 2016.

How it all works

In the early version, the table did not even have a division by month: one sheet contained a stream of dates for more than a year. But gradually I had new sources of income and expenses, there were more and more entries, and it took too long to turn the page.

Then I began to divide the periods of life into different sheets within the same file, adding something new to each new page. Then the need for self-analysis arose, and I began to highlight the weeks with colors in order to roughly imagine how much I spend over a certain period.

“There is a fear that there will be no money at all”: 7 financial habits from our childhood

Now the table consists of several sheets, each of which performs its own task.

Sheet «Template» — the main one to be used, it can be copied and multiplied for different months. It consists of several columns: income, expenses and credit. Each column is divided into four items: transaction category, amount, date, and comment. On the right side, there are additional fields that allow you to keep track of your current balance or check spending in various categories.

The «Categories» sheet allows you to summarize the indicators in all categories for the entire time the table is filled. Now you will always know how much money was spent on this or that type of expenses, how much you spent on average monthly or per year.

Instruction sheet. Here is a detailed description of all the features of the table and an explanation of how to use them.

The “Template” sheet can be used as a basis On the same sheet there is an additional section with which you can monitor the balance and make adjustments to it The “Categories” sheet allows you to categorize income and expenses The “Debt Accounting” section on the same sheet with categories On the last You can find detailed instructions for maintaining table

on the sheet. The table requires meticulous maintenance of expenses and income — up to the ruble. This is a laborious task, especially in the process of forming a habit. But with the advent of the era of cashless payments, it became easier: now all expenses are stored in the bank application, from where they can be transferred to the table even with a delay of several days.

To keep track of cash, I use the following life hack: since I had a real salary, I stopped counting coins in my wallet and write down the expenses of banknotes. For example, if the purchase cost me 80 R, I write down 100 R, and put 20 R in my pocket. In the future, I will record a purchase of 120 R as 100 R, adding 20 R with coins from my pocket.

If you fill in the table all the time, you will always see your current balance. The math is simple: starting amount ± starting debts + income — expenses — loans ± new debts.

Table specifics

Daily limit. You can limit your spending in the quest format by using daily limits, which every day increase the allowable amount of expenses for the selected category by the specified value. Often such functions are presented in the form of an API or additional programs, but everything works for me exclusively on the regular capabilities of tables, although this solution turned out to be quite cumbersome.

Daily limits help break bad financial habits or form new good ones. For example, you can set 400 R per day for entertainment, even though you usually do not spend that much, and force yourself to spend money on this category every month. I used this feature when I started to feel addicted to something. It can be harmless coffee, going to the movies or favorite snacks, or it can be alcohol and cigarettes.

Why is it so difficult to spend money on yourself

The function works like this: every day the table gives you the amount that you can spend on the selected category. If you want to buy something, first save up money for your Wishlist. And if you couldn’t resist and still bought, the daily limit will show a negative value. Relatively speaking, you borrowed money from yourself and now you must return it.

To «enable» limits, you need:

- Go to the «Template» sheet or a specific month.

- In the «Limits per day» section, indicate the categories you are interested in and estimate the maximum amount that you can spend on them every day.

If you do this on the «Template» page, keep in mind that after that you need to transfer everything that you have fixed to the page of the current month.

- In the date line, specify the first day of the current month and drag the bottom corner of the cell to stretch it down. Then the table will work by itself.

Self test calculator. Over time, some expenses may slip away — for example, an unexpected charge will occur from the card or a cell will fall out of your pocket. This is inevitable, because life is not a computer model, so sometimes the calculated balance needs to be adjusted.

To make an adjustment, you will have to look into all applications and wallets and manually record the total amount of finances in the «De facto balance» sub-table. After that, the «Self-Check Results» table will display the difference between the actual balance and the calculated one. You can analyze this value, try to find lost or extra money, or simply accept and move on.

7 useful formulas for those who count money in an excel spreadsheet

To correct the error, you need to enter the resulting difference in the special sub-table «Adjustment of the calculated balance», which is located to the right of the «De facto balance» on the page of each month, and indicate the date of the check. As a result, the total amount of available funds will change, the difference will become zero, and the recorded value will pass by all categories.

Disadvantages of the table

As I said, every application and every table is tailored to the needs of their creators, and this one is no exception. The advantages of my table are convenience and friendly interface. And the result of its management is an understanding of your finances at the moment and in the future.

But there are also shortcomings that can be critical for someone:

- Technically, it is very easy to maintain a table, in practice — you need to enter all expenses and incomes up to a ruble.

Not everyone will be up to this task. And if you want to keep a family budget in it, both of you must be perfectionists.

- The table teaches planning, but there is no functionality in it that “blocks” money in advance for monthly expenses such as housing and communal services. You need to remember about such expenses yourself. The table only forms an understanding of how much is spent on this business every month.

- It is not possible to split spending into subcategories in the table. It will not be easy for those who care to understand how much money is spent on meat, how much on fish, how much on fruits, and how much on sweets for tea. To break the category «Products» into these items, you will have to study each check. It is difficult and long.

- There are no graphs in the table. But if you wish, you can collect them yourself, all the necessary data is there.

- A table can only be maintained in one currency. If you receive money and spend it in several currencies at once, you will have to constantly bring them to the same value.

To do this, the table has current exchange rates by which you can multiply any amount.

If these shortcomings are acceptable for you, perhaps you will succeed with this plate.

How to start working with the table

The table itself has detailed instructions for use on the last page. To start budgeting in this spreadsheet, you need to:

Create a copy of the spreadsheet in your Google Drive. To do this, follow the link and click the corresponding button in the drop-down window. The copy becomes your personal copy.

Fill in the «De facto balance» sub-table on the «Template» sheet. You will need to designate all places where money is stored: cards, deposits, cash. The left side of the section is needed to record money that you do not want to include in your monthly budget, such as savings. The columns in the middle are all the cards and cash you have in circulation. And the columns on the right are credit cards with their limits and balances.

Create a copy of the «Template» page and specify the current month in the name of the new sheet. For example, «January».

Fill in the table «Input debts» on the sheet «Categories» — sum up your debts and write them down in the appropriate cells.

Specify the required categories on the «Categories» sheet. After you add the necessary categories on this page, they will automatically be pulled up to the rest of the sheets and appear in the columns highlighted in blue. A drop-down list with the listed categories will appear in income and expenses, which can be supplemented at any time.

Fill in the sub-table «De facto balance» on the sheet of the current month and write down all the rubles that are currently available. You will get three values: «Total», «Balance for the month» and «Credit». The first is all your savings, the second is the money you plan to live on, the third is the amount on all credit cards.

Enter the value from the «Balance for the month» in the first line of income. If you have a loan, you need to enter it in the «Credit» section in the same way. The difference with the settlement balance will become zero.

Enter income and expenses. Everything is ready, now you can simply add up-to-date data during the month.

At the end of the month, create a copy of the «Template» sheet and move the «Current Balance» to the first line of income on the new sheet. If you want to check the correctness of the calculations, you need to fill in the «De facto balance» again and enter the difference with the calculated balance in the «Adjustment of the calculated balance» section — the current value will be updated.

Result

The spreadsheet is my self-control tool. Now I can do without her, although it will be unusual, as she helped me become more disciplined. If I had not initially come to this method of budgeting, it would have been much more difficult for me to plan large expenses and manage savings.

Download template

My wife also uses this table: we started keeping a common budget as soon as we started living together. She accepted my approach and immediately joined the process. Maybe she didn’t have the same interest as me, but she understood that this was a good thing and important for both of us. Now everyone has access to the table and writes down their expenses upon purchase or in the evening after shopping. My wife got used to this system quite quickly, because over the years the table has become not only convenient, but also beautifully designed and intuitive.

As a result, in three years we never fell into financial traps. We always have money for the current month with a reserve of one and a half times, as well as an airbag for unforeseen expenses.

Excelki. Here they brag about their achievements in Google Spreadsheets

Information about court arrests and collection of bank accounts in VTB

-

What is the difference between arrest and recovery

-

What to do if an account is frozen or funds are recovered

-

How to remove an arrest or collect a debt

To the debtor To the collector

To the debtor

To the collector

Useful information

Arrest

account.

seized, or withdraw it from an ATM

will not work. But money beyond that

amounts will be available

Recovery

Write-off of money from the account in favor of

claimant. It happens without you

consent, court order

or the order of the bailiff

Why was the money seized or collected?

The bank complies with the requirements of the enforcement document, it does not arrest

and does not collect money from accounts on its own. After write-off, funds

are immediately sent to the account of the bailiff or claimant

Executive document

This is a document received by the bank, which confirms the existence of a debt.

It can be a writ of execution, a court order or an executive order.

notary’s inscription. The bank receives executive documents from the FSSP,

notaries, courts and recoverers — individuals and legal entities 9What to do?

To the debtor

How to remove the arrest?

How to stop collecting?

What are the common reasons for arrests and penalties?

How to keep the living wage on the account?

I do not agree with the arrest or collection or the amount of the debt was written off twice

still arrested, why?

What is a performance fee? When is it charged?

How to make an appointment with the bailiff?

For mobilized citizens

What to do if you receive a summons?

Where to apply?

How to apply for Public Services?

For the collector

How to collect money through the bank?

Why didn’t the bank transfer the entire amount of the debt to me?

How to revoke a writ of execution?

Optional

Types of executive documents

In accordance with Article 12 of the Federal Law of 02.

If you do this on the «Template» page, keep in mind that after that you need to transfer everything that you have fixed to the page of the current month.

If you do this on the «Template» page, keep in mind that after that you need to transfer everything that you have fixed to the page of the current month.  Not everyone will be up to this task. And if you want to keep a family budget in it, both of you must be perfectionists.

Not everyone will be up to this task. And if you want to keep a family budget in it, both of you must be perfectionists.  To do this, the table has current exchange rates by which you can multiply any amount.

To do this, the table has current exchange rates by which you can multiply any amount.